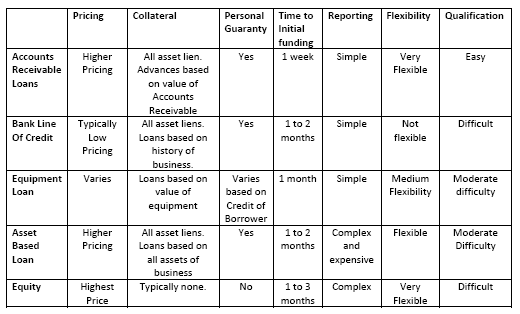

TAB Bank (@TABBank) provides custom working capital solutions to commercial businesses from many industries. These solutions are provided in all stages of business life cycles during any economic conditions. TAB Bank does this through Accounts Receivable Financing, Lines of Credit,Equipment Finance, Asset Based Loans, Business Accounts, and Commercial Banking Services.

Fast A/R Funding is a nationwide specialty finance company that provides working capital facilities for companies through factoring receivables. The goal of the professionals at Fast A/R Funding is to help small business owners improve their cash flow and grow their business. Fast A/R Funding can help their clients get the cash flow they need in as little as 48 hours. Their clients also have the advantage of partnering with a finance company that employs an industry-leading proprietary factoring software that makes the entire factoring process paperless.

“We are very pleased to partner with a financial institution that understands the factoring industry as well as TAB Bank does. Their team of commercial finance professionals have years of experience in the industry. I am extremely confident in their ability to provide outstanding service and support to Fast A/R Funding in the coming months and years,” stated Matthew Begley, CEO of Fast A/R Funding.

“Fast A/R Funding is a great fit in TAB’s portfolio of Rediscount clients. They provide exceptional services for their growing number of clients. They are led by an outstanding team of seasoned professionals. Their leadership team has years of experience in the factoring industry and they know the ins and outs of the industry just about as well as anyone. We were also very impressed with their operational and customer-facing systems. They utilize the latest in technology through the use of innovative systems and processes,” commented Chris Abel, Vice President of Loan Underwriting at TAB Bank.

Contact Information:

Trevor Morris

Marketing Manager

801-624-4418

trevor.morris@tabbank.com

Twitter - @TABBank

Facebook – facebook.com/TABbank

Matthew Begley

CEO

Fast A/R Funding

888-833-2286

mbegley@fastarfunding.com

Twitter - @Factoringinvoices

Facebook – facebook.com/fastARfunding