As a small business owner you may have heard the following terms when it comes to invoice financing:

- factoring

- Invoice discounting

- Invoice funding

- Invoice purchasing

- Invoice Funding

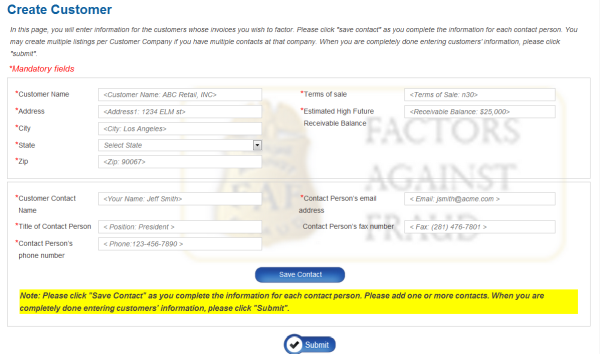

The basics of a invoice finance transaction involves three parties.

- A business that sells goods or services to another company on open account like 30 day terms.

- The company that buys the goods or services from #1.

- An Invoice finance, or factoring company.