2013 is full of promise and opportunity for

your business. Even though there may be challenges, there is always opportunity. Winston Churchill once said, “A pessimist

sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty.”

Tags: Cash Flow, Business Loans, Small Business

Seeking out funding is a big step for any business. Whether it’s a startup looking for their first round capital or a seasoned business looking for a little more cash flow, short-term business loans are a popular option. They allow you to get the funding you need on a short-term basis without giving away half of your business to an outside investor.

It is a simple fact: In order for small businesses to survive, they must have cash. We all know how you get the cash to successfully meet obligations: converting accounts receivables into cash.

Tags: Business Loans, Small Business

When you think about business funding what comes to mind? A loan from the bank? Tapping personal credit cards? Using your own savings? Some kind of specialized cash flow financing?

Tags: Business Loans, Accounts Receivable Factoring, Small Business

There are many reasons why it is important to have a stable capital base for operating your business. Stability offers safety in today’s volatile markets. Whether the source of your stable capital is equity investment by the owners/shareholders or whether you have some sort of commercial finance loan, the benefits of knowing you have money available at a moment’s notice gives you the flexibility you need as a business owner.

Tags: Business Loans, Small Business

As 2012 comes to a close, we are fast approaching the holiday season. Everyone’s getting ready to do their holiday shopping, gearing up to devour all that great holiday food and watch football while regretting all that great holiday food they devoured.

Tags: Invoice Factoring, Business Loans

Wow … I can’t believe that 2012 has almost come and gone. The thing that has stood out the most to me from a business perspective is how many companies continue to seek out small business funding. While it seems there’s some economic recovery, the one thing I can tell you is that banks are still holding a tight rein on small business funding.

Tags: Cash Flow, Business Loans

When looking into the various options to finance your business you need to make sure you understand business loan rates and terms. Many small business owners are familiar with the basics of loans from dealing with their personal finances.

Tags: Business Loans

Have you found yourself in a pickle and just realized that you need cash today for a business operating expense such as payroll or an inventory purchase? Or, is there a great deal to be made with a vendor to save your company money, if you are able to pay the vendor in the next week or so?

Tags: Business Loans, Small Business

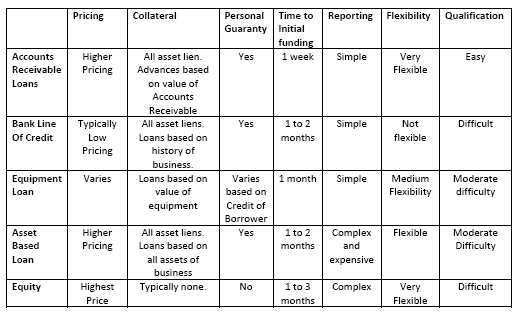

One of the questions I am asked on a regular basis is how accounts receivable loans match up to other financing products available to small businesses. I created the matrix below as a simple way to compare the most important aspects of different forms of available financing.

Tags: Invoice Factoring, Business Loans