When looking into the various options to finance your business you need to make sure you understand business loan rates and terms. Many small business owners are familiar with the basics of loans from dealing with their personal finances.

When looking into the various options to finance your business you need to make sure you understand business loan rates and terms. Many small business owners are familiar with the basics of loans from dealing with their personal finances.

In some ways a business loan is similar to a mortgage or an automobile loan; however, there are some key differences that impact your business.

The three key areas are interest rates, how fees impact your APR and length of the loan.

Interest Rates

The concept of an interest rate is pretty basic. The amount of interest you pay over the life of a loan equals the interest rate multiplied by the balance of the loan.

The difference with a commercial loan is how the interest rate is defined and how it is used to determine the amount you pay.

Fixed vs. Variable

An interest rate is fixed or variable. A variable rate is typically pegged to the prime rate or LIBOR, but is based on practically anything – specific dates, performance benchmarks, debt leverage, etc.

In a variable rate loan, the interest rate is the benchmark rate plus the spread. If your rate was prime + 5.00% (this may be stated as prime + 500 basis points) you would need to look up the prime rate (the Wall Street Journal’s bank survey is typically used) and add 5.00%. The prime rate is currently 3.25%. Therefore, the interest rate on this loan would be 8.25%.

This rate may then be charged on the average balance over a certain period or may be based on the balance and the end of the month.

Fees and Their Effect on the APR

Another thing to keep in mind when reviewing business loan rates and terms is the fees that are charged up front and over the life of the loan. A loan with a low rate and a pile of fees is significantly more expensive than a higher rate with minimal fees.

You’re probably familiar with the term APR or annual percentage rate. Think of APR as the amount you are paying on an annual basis that does not reduce the principal balance as a percentage of the loan.

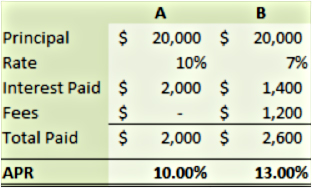

Let’s look at an example of a $20,000 interest-only loan with a one-year term. For loan A, the interest rate is 10% and there are no fees. With loan B, the rate is 7% but there are a number of fees that come out to $100 per month.

As you see, B is the more expensive loan. The APR is 13% compared to 10% for loan A. Fees have a big impact on the overall cost of the loan.

Common Loan Terms

Loan terms fall into two broad categories depending on the type of loan.

Working Capital Loans

Working capital loans have short terms from a few months to four or five years. At the end of the term, the entire balance is immediately due. These are typically revolving facilities wherein the principal does not amortize and the payments are interest-only.

Term Loans

Term loans, as their name implies, are for a fixed term – or period of time. These are typically used to purchase an asset. This may be equipment, real estate or any other large asset with a fixed useful life.

The length of the loan is usually based on the useful life of the asset being financed. An equipment loan may be for five years, while a real estate loan could be for 20 years or more.

These loans may or may not have an amortization provision. If the funds are used to purchase a depreciating asset, the loan amortizes in step or slightly faster than the projected depreciation of the asset.

Finding the Perfect Business Loan

Finding the loan that is right for your business depends on your business funding needs. Once you have decided on the type of loan that fits your situation, make sure you understand the business loan rates and terms and the impact they have on your business.

Fast A/R Funding specializes in helping small businesses bridge the cash flow gap with factoring. Download our informative “Factoring 101” guide, or call 888.833.2286 to speak with one of our small business finance consultants.