Happy Monday. Today's Accounts Receivable Financing blog will focus on how availability is generally calculated for our clients.

Happy Monday. Today's Accounts Receivable Financing blog will focus on how availability is generally calculated for our clients.

In our demonstration we will assume that Fast A/R Funding has a new client the sells approximately $100,000 a month in invoices to us that are due from credit worthy payors.

Our client creates a $10,000 dollar invoice using our online invoice creation tool and looks in our system to see what his availability is.

The availability starts with the amount of accounts receivable that have been sold to us. For our example lets assume that including the new invoice that was created the client has a total of $110,000 in invoices that have been sold to us.

We then subtract any invoices that are considered ineligible from the gross receivables sold. Click here for a link to the first in a series of blogs that we have written previously on ineligible invoices. In our example there are no ineligible accounts receivable.

Once we have subtracted any invoices that might be considered ineligible for various reasons, we then apply apply our advance rate. In our example lets assume that our client has an 85% advance rate. 85% of $110,000 equals $93,500. The client has invoices sold to us that could support advances of $93,500.

Once we know what the accounts receivable can support, we then subtract from that amount previous advances made to client. In this example lets assume that the client has previously received advances of $80,000.

We then subtract $80,000 from $93,500, leaving $13,500 available. Once this calculation is completed we then subtract what the estimated fees that are due Fast A/R Funding if the invoices were all paid today. Let's assume $1,000.

$13,500 minus $1,000 leaves us with $12,500 in availability that we can wire to the client today.

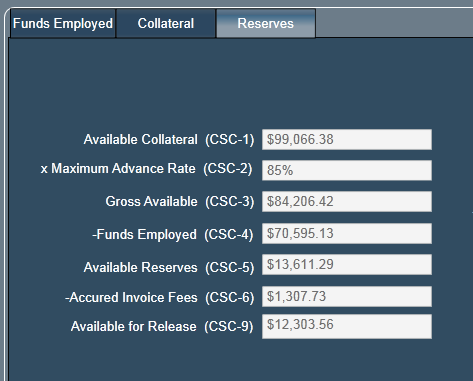

I have attached a screen shot from our system with different numbers that can give you a visual representation of the example. Remember the numbers are different but the calculation is the same.

In the example above the client has $12,303.56 available as of the day this was printed.

One of the important things to remember is that all of these calculations are on line with our custom developed accounts receivable financing software that is available to our clients 24 hours a day, 7 days a week.

Click the button below to learn more about accounts receivable financing with Fast A/R Funding.