You’ve determined you’re going to use accounts receivable finance to unlock cash available in a business invoice or pool of invoices. So now, how do you ensure you choose the right factoring program for your company? Here are three simple steps to remove much of the hassle associated with making the wrong choice and going with the wrong firm.

Three Steps To Find The Right Factoring Program For Your Business

Posted by Jonah Schnel on Thu, Dec 27, 2012

What Is Factoring And How Does It Work For Your Business?

Posted by John Mauldin on Wed, Dec 19, 2012

In today’s economic environment, it is becoming increasingly difficult to obtain small business financing from traditional banks.

Tags: Invoice Factoring

Secure Business Funding: The Best Gift For Your Company

Posted by Jeremy Waller on Mon, Dec 17, 2012

It’s that time of the year again -- the season of giving. No doubt you’ve made your list and are dreading fighting the crowds to find the perfect gifts for friends and family, but have you considered the gift for your company this year?

Tags: Invoice Factoring

Despite being around for centuries and being used across practically all industries, there are a lot of misconceptions about the factoring loan. Much of this misunderstanding comes from not being familiar with this type of financing. In fact, factoring isn’t all that different from many other types of short-term business loans.

If there’s one thing I’ve learned during my tenure in the commercial finance industry, it is that there are all sorts of business management styles. What I mean is, there are small business owners who have a handle on their business’ financial side and there are others that don’t. Improving cash flow is on the radar for both types.

As 2012 comes to a close, we are fast approaching the holiday season. Everyone’s getting ready to do their holiday shopping, gearing up to devour all that great holiday food and watch football while regretting all that great holiday food they devoured.

Tags: Invoice Factoring, Business Loans

What is factoring? Factoring is the process of selling commercial accounts receivable to a factor at a discount. The factor pays the seller of the accounts receivable cash in exchange for the rights to collect payment from the seller’s customer. The seller benefits by receiving the majority of the amount due from the customer immediately, instead of having to wait 30, 60 or 90 days to be paid, and the factor benefits by charging a fee for the service.

Tags: Invoice Factoring

Should You Use A Factoring Program For Cash Flow Funding?

Posted by John Mauldin on Wed, Nov 07, 2012

If you’re a small business that has struggled with cash flow because of slow collections on your invoices, you need to consider a factoring program. Factoring is a form of commercial cash flow funding or financing where you sell your company’s accounts receivables to a third party known as a factor.

Tags: Invoice Factoring, Cash Flow

Factoring companies have been a part of the staffing industry for a long time. Factoring and staffing companies work well together because of the nature of the staffing industry. Staffing companies provide a service that is easy for factoring companies to measure and analyze.

Tags: Invoice Factoring

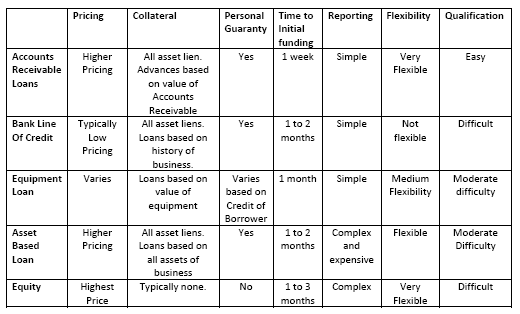

One of the questions I am asked on a regular basis is how accounts receivable loans match up to other financing products available to small businesses. I created the matrix below as a simple way to compare the most important aspects of different forms of available financing.

Tags: Invoice Factoring, Business Loans