Invoice Finance? It's Just Another Term for Invoice Factoring!

Posted by Jonah Schnel on Wed, May 23, 2012

Invoice Finance -- what exactly is it? Well, candidly, it's just another term used for traditional invoice Factoring. Within our niche industry, we hear all kinds of names for the same basic service including invoice finance, accounts receivable finance, invoice factoring, factoring, invoice discounting, working capital finance, etc. The list seems to get longer each year. We're not really sure why people want to come up with different names for the same basic process, but maybe that's just an effort to try to be cool...or maybe people just forget to use the same name and so they choose that name that is on the tip of their tongue...and all of a sudden the names just keep evolving like a good old fashion game of telephone (like you use to play when you were 8 years old)!

Factoring Invoices - Why is Customer Notification Important?

Posted by matthew begley on Tue, May 15, 2012

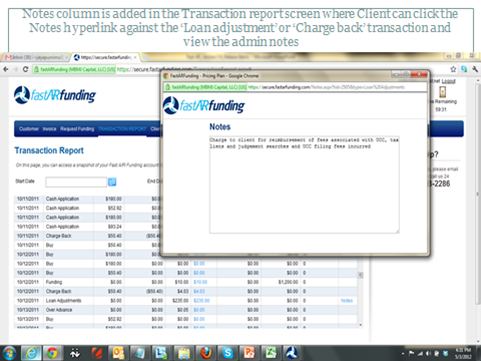

Factoring Receivables - New Client Reporting Functions

Posted by matthew begley on Mon, May 07, 2012

Tags: Invoice Factoring

Small Business Factoring - Does Your Personal Credit REALLY Matter?

Posted by Jonah Schnel on Wed, Feb 22, 2012

You've seen advertisements from many small business factoring companies indicating that your personal credit does not matter and that factoring companies really only rely on the credit worthiness of your customers. This is true to a large degree, however, it is important to note that many small business factoring companies want to get a sense of how much a person cares about maintaining a good credit history.

Tags: Invoice Factoring

Invoice Factoring - It's the best alternative when you need cash!

Posted by Jonah Schnel on Wed, Feb 01, 2012

Let's face it, when you need cash for your business for growth, to make payroll, to purchase equipment or raw materials, it isn't always readily available. The traditional places entrepreneurs think they should go are a bank (for a loan) or Angel or venture capital investors (for equity). In today's investment climate, both are probable dead ends...why??