Happy Monday. Today's Accounts Receivable Financing blog will focus on how availability is generally calculated for our clients.

Account Receivable Financing - How is Availability Calculated

Posted by matthew begley on Mon, Aug 08, 2011

Account Receivables Factoring Service - Online, All the time!

Posted by matthew begley on Tue, Jun 28, 2011

The fifth part of our series on the process of how accounts receivable funding work we will focus on how Fast A/R Funding's clients get advances through our electronic factoring platform.

As part of our efforts to make the process as efficient as possible for our customers we ask them to attach their business wire instructions to their online account with Fast A/R Funding.

At the end of the application process for new customers, we ask our customers to enter their banking instructions on their online client dashboard. Once this is done, we are able to process accounts receivable funding and make continued wires to our clients with minimal effort. There is no waiting for advances once a week and there is no waiting and hoping that a check arrives in the mail.

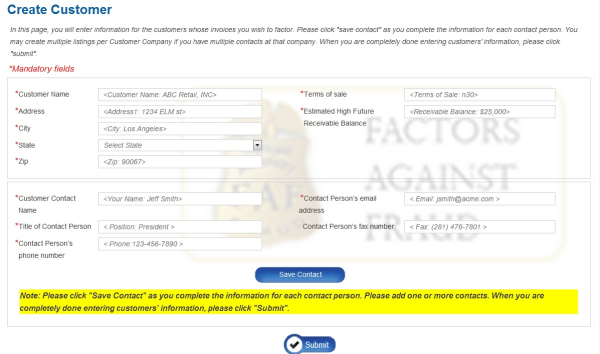

Part Three of our discussion about online spot factoring with fast A/R Funding will focus on the creation of a new customer on our system.

A Factoring Contract is a two party legal document between a factoring company and a business entity. The goal with factoring contracts is to outline the legal relationship between a factoring company and its client.

Business Factors - Identity Verification with efactoring !

Posted by matthew begley on Tue, May 24, 2011

Electronic identity verification is part of the completely online small business factoring program that we created for our customers.

Factoring Advance Rates Part 1 Los Angeles Small Business Factoring!

Posted by matthew begley on Mon, May 16, 2011

Today's article will be about how factoring companies determine advance rates for their clients. I will be using examples of companies in Los Angeles because even though Fast A/R Funding is a nation wide factoring company, we are head quartered in the Los Angeles area of Southern California.

Ineligible Accounts Discussed - Commercial Finance Factoring, Part 2!

Posted by matthew begley on Thu, May 12, 2011

In part 1 of this series, we discussed the different types of ineligible invoices and why factoring companies make them ineligible.