Factoring for Dummies - the Basics

The premise is fairly simple. The business provides a product or service, then bills its customer. The customer then has (on average) 30 days to pay that outstanding invoice, which creates a receivable for the business that provided the product or service. The challenge for the business here is that it has no way of knowing exactly when that money from its customer will come in. Will the customer pay early? On time? Late? Some business owners incentivize early payments by customers by offering a 2% discount when customers pay outstanding invoices within 10 days instead of toward the end of their net 30 agreement. For customers who have the working capital to take advantage of this savings, this is an excellent option because saving money is always a good thing. But most customers don’t take advantage of these discounts, and that’s where a funding business that specializes in factoring comes in.

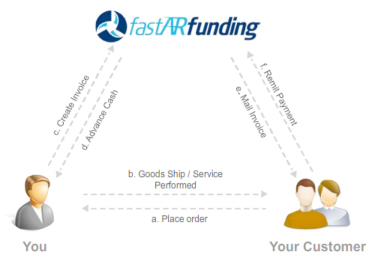

As mentioned above, the business’ accounts receivable, created by the sale of goods/services, is actually an asset that can be leveraged for cash, much like a house can be financed as an asset. The funding business or, factor, typically purchases the business’ accounts receivable at a slight discount, providing a rapid influx of working capital to the business. When the related invoices are due, the customer makes payments directly to the factor instead of the original business (since the factor now owns the invoice/accounts receivable).

The Benefits

This system of small business financing has several benefits to both the factor and the business owner:

-

Cash today - The small business owner receives an influx of cash. This increase in working capital enables the business to take advantage of opportunities such as receiving early payment discounts from its own vendors, investing in marketing or covering critical near-term expenses such as employee payroll. Over time and with enough volume, the business owner is able to have a more reliable idea of how much money the company will have and when, which makes planning, budgeting and growing easier and faster.

-

Customer credit review - The factor has the ability to evaluate the creditworthiness of the business owner’s customers. That means the factor can determine which invoices to purchase by making an informed prediction of which customers are most likely to pay on time. The factor then buys those invoices at less than face value and ideally receives full face value from the customer within the time frame agreed.

The Modern Twist

Up until the first decade of the 21st century, factoring in America was, by and large, limited to larger companies with high volumes and large receivables. Factoring was an involved process that simply didn’t make smaller volume factoring cost-effective for large finance companies. That left small business owners out of the loop, which is particularly unfortunate considering how large a portion of the American economy these small businesses represent.

The Internet has changed the way factoring can be delivered to small businesses and “online factoring” is now a reality with Fast A/R Funding. With online factoring, the administrative and operational costs to the factoring company are greatly reduced, and the ability to provide factoring to small businesses is greatly increased: a win-win all around. In addition, online factoring makes it possible for small business owners to deal with a finance company that may be located across the country, as there’s no inherent need to be geographically close to the factoring firm.

This article, “Factoring for Dummies”, is just meant to be a short introduction on the process and benefits of factoring. To learn more about how factoring can help the cash flow of your business, download our “Factoring 101” guide or give us a call at 888.833.2286.