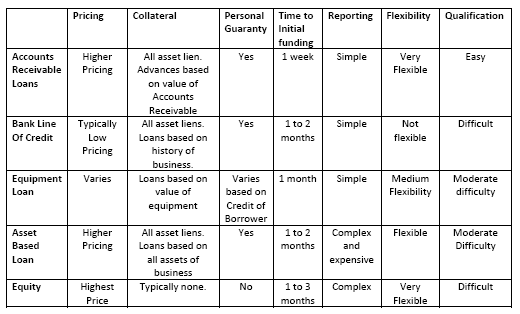

One of the questions I am asked on a regular basis is how accounts receivable loans match up to other financing products available to small businesses. I created the matrix below as a simple way to compare the most important aspects of different forms of available financing.

Tags: Invoice Factoring, Business Loans

As a small business owner or manager, you work hard to ensure that revenue is generated, expenses are managed well and profits are made. Along with that, you make sure your business cash flows efficiently and you are able to service your debt, pay general and administrative expenses, and make payroll. You’re running a tight ship that’s the product of your handiwork.

Tags: Payroll

Is Factoring a Way to Get a Short-Term Business Loan?

Posted by Vanessa Johnson on Thu, Oct 11, 2012

A short-term business loan is typically used to fill a temporary cash flow gap and is repaid in 90 to 120 days. Short-term loans are a great way for a business to meet a temporary cash flow problem. Below are a few situations where a short-term loan may be beneficial to meet a cash crunch.

Tags: Invoice Factoring, Business Loans

Truck Factoring: The Truth About Picking the Right Factoring Company for You

Posted by matthew begley on Wed, Oct 10, 2012

There are many factoring companies that specialize in truck factoring, or financing transportation companies. The truth is that most of them do a really good job, providing a professional, honest product. Do some research on the International Factoring Association website, www.factoring.org, to find this solid, core group of factoring companies. Companies looking for a new factoring company should ask their associates in the trucking industry for referrals to companies that have done truck factoring. Once that group of factoring companies has been identified, then it’s up to you to research which firms have the characteristics you value the most.

Business owners often ask me to define factoring for them. I quickly explain it to them, but after doing so, I usually ask them why they need the cash. There is a lot to be gleaned from the responses I hear back. These responses determine if the company in question has a short-term cash flow need, or if a long-term gap in working capital is likely.

Are you an entrepreneur who has started your own business and now you’ve discovered you need cash? If you’ve been reading what I’ve been writing, then you may have picked up on a theme: you need cash to run a business.

Tags: Business Loans

Let’s face it -- managing cash flow is a top priority for business owners and at some point, every business faces a cash crunch.

Tags: Business Loans

What We Learned From Factoring Accounts Receivable for Clients

Posted by matthew begley on Mon, Oct 01, 2012

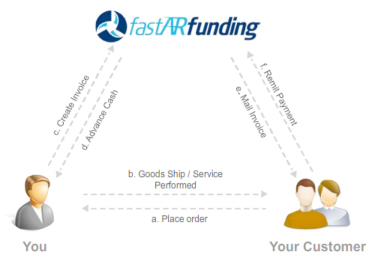

Factoring for Dummies - the Basics

The premise is fairly simple. The business provides a product or service, then bills its customer. The customer then has (on average) 30 days to pay that outstanding invoice, which creates a receivable for the business that provided the product or service. The challenge for the business here is that it has no way of knowing exactly when that money from its customer will come in. Will the customer pay early? On time? Late? Some business owners incentivize early payments by customers by offering a 2% discount when customers pay outstanding invoices within 10 days instead of toward the end of their net 30 agreement. For customers who have the working capital to take advantage of this savings, this is an excellent option because saving money is always a good thing. But most customers don’t take advantage of these discounts, and that’s where a funding business that specializes in factoring comes in.

Tags: Invoice Factoring

One of the biggest stress factors for a small business owner is making sure that they are able to make payroll. Over the years, I have heard this repeatedly from my clients, friends and family members that are small business owners because they know they are responsible for another person’s (and their family’s) livelihood.

Tags: Payroll