As a business owner, you should be aware of the 2013 tax law changes impacting your business and, more importantly, your cash flow. Most notable are the changes in payroll taxes that employers are responsible for paying federal and local tax agencies on behalf of their employees. Here are some of the changes to expect.

How Payroll Financing Helps Your Company Adapt To 2013 Tax Changes

Posted by Vanessa Johnson on Thu, Feb 28, 2013

Tags: Payroll

As a business owner, having the capital to keep your business running is a top priority. Many businesses seek outside financing early on so that they have the ability to operate and grow. As a small business, it’s difficult to find a bank that’s willing to work with you.

Tags: Invoice Factoring

TAB Bank Provides Fast A/R Funding With a Rediscount Credit Facility

Posted by matthew begley on Mon, Feb 25, 2013

TAB Bank (@TABBank) provides custom working capital solutions to commercial businesses from many industries. These solutions are provided in all stages of business life cycles during any economic conditions. TAB Bank does this through Accounts Receivable Financing, Lines of Credit,Equipment Finance, Asset Based Loans, Business Accounts, and Commercial Banking Services.

Fast A/R Funding is a nationwide specialty finance company that provides working capital facilities for companies through factoring receivables. The goal of the professionals at Fast A/R Funding is to help small business owners improve their cash flow and grow their business. Fast A/R Funding can help their clients get the cash flow they need in as little as 48 hours. Their clients also have the advantage of partnering with a finance company that employs an industry-leading proprietary factoring software that makes the entire factoring process paperless.

“We are very pleased to partner with a financial institution that understands the factoring industry as well as TAB Bank does. Their team of commercial finance professionals have years of experience in the industry. I am extremely confident in their ability to provide outstanding service and support to Fast A/R Funding in the coming months and years,” stated Matthew Begley, CEO of Fast A/R Funding.

“Fast A/R Funding is a great fit in TAB’s portfolio of Rediscount clients. They provide exceptional services for their growing number of clients. They are led by an outstanding team of seasoned professionals. Their leadership team has years of experience in the factoring industry and they know the ins and outs of the industry just about as well as anyone. We were also very impressed with their operational and customer-facing systems. They utilize the latest in technology through the use of innovative systems and processes,” commented Chris Abel, Vice President of Loan Underwriting at TAB Bank.

Contact Information:

Trevor Morris

Marketing Manager

801-624-4418

trevor.morris@tabbank.com

Twitter - @TABBank

Facebook – facebook.com/TABbank

Matthew Begley

CEO

Fast A/R Funding

888-833-2286

mbegley@fastarfunding.com

Twitter - @Factoringinvoices

Facebook – facebook.com/fastARfunding

Tags: news

While we think there may be some improvement in the economy going into 2013, there is still a lot of uncertainty regarding how banks are going to loosen the purse strings to small businesses.

Tags: news

The Online Factoring Company: Manage Your Business Financing 24/7

Posted by John Mauldin on Thu, Feb 21, 2013

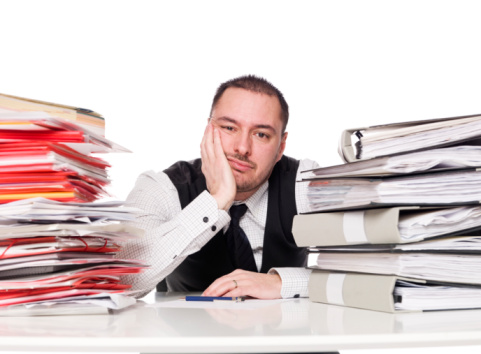

Some of you small business owners out there probably understand how hard it is to obtain traditional bank financing. There’s so much documentation you have to provide and the process is often quite cumbersome depending on the institution you’re working with, especially in today’s economic climate. If you have to work directly with a loan officer who handles everything, it may be difficult to get a hold of him or her at times.

Tags: Online Factoring

Factoring Loan Details -- What You Need To Know To Grow Your Business

Posted by Jeremy Waller on Wed, Feb 20, 2013

Pulsing in every business owner’s mind is the thought of growing the business. How do you find more people interested in your product

or service? How to you reach them? Do you

have the personnel to handle the increased volume? And, most importantly, do you have the financial resources to accommodate an increase in new business?

No matter the industry (manufacturing, distribution, construction or services) there is one common thing that is needed for your business to be successful and survive.

Tags: Payroll

What Banks Don't Want You To Know About Short-Term Business Loans

Posted by Jeremy Waller on Thu, Feb 14, 2013

The first thing that comes to mind for most when considering short-term business loans

is talking to the bank whey they have their operating account. It seems obvious that the first place to look for a business loan is

at your bank.

Tags: Cash Flow, Small Business

Build Your Client Base By Investing In Invoice Discounting

Posted by John Mauldin on Wed, Feb 13, 2013

In my tenure in the commercial finance industry, I have learned a lot about what to

do and what not to do when it comes to running a business. One thing you must do

to successfully run a business is to

stay organized.

Tags: Invoice Discounting

Cash Flow Financing Keeps Your Bottom Line Stable Off-Season

Posted by Jeremy Waller on Mon, Feb 11, 2013

Managing the finances of a seasonal business is challenging. Certain expenses invariably decrease when business slows; however,

fixed expenses such as office space, salaried employees, insurance and others remain the same no matter how slow the off-season

may be.

Tags: Cash Flow, Small Business